Author: Nikka / WolfDAO (X: @10xWolfdao)

I: The Dramatic Shift in VC Investment Logic

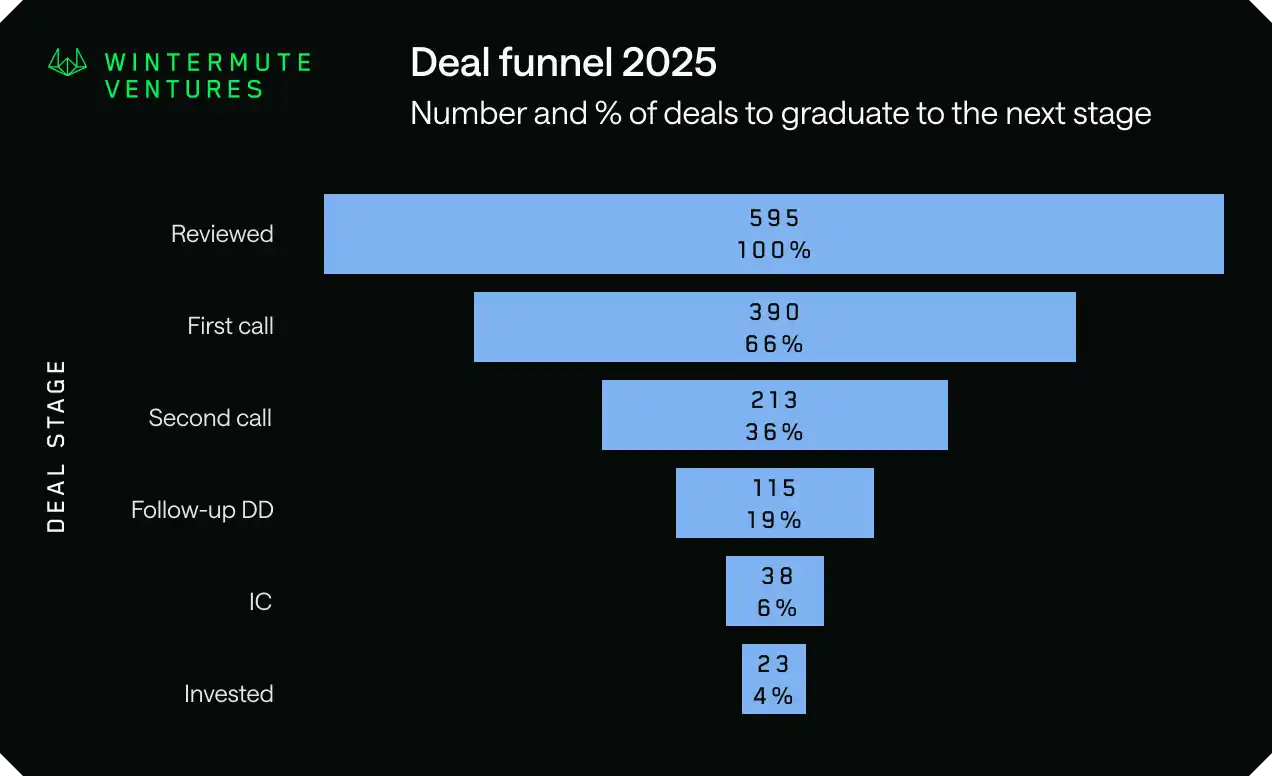

Data from Wintermute Ventures in 2025 reveals a harsh reality: this top market maker and investment firm reviewed about 600 projects throughout the year, ultimately approving only 23 deals, an approval rate of just 4%. Even more extreme, only 20% of projects even made it to the due diligence stage. Founder Evgeny Gaevoy bluntly stated that they have completely moved away from the "spray and pray" model of 2021-2022.

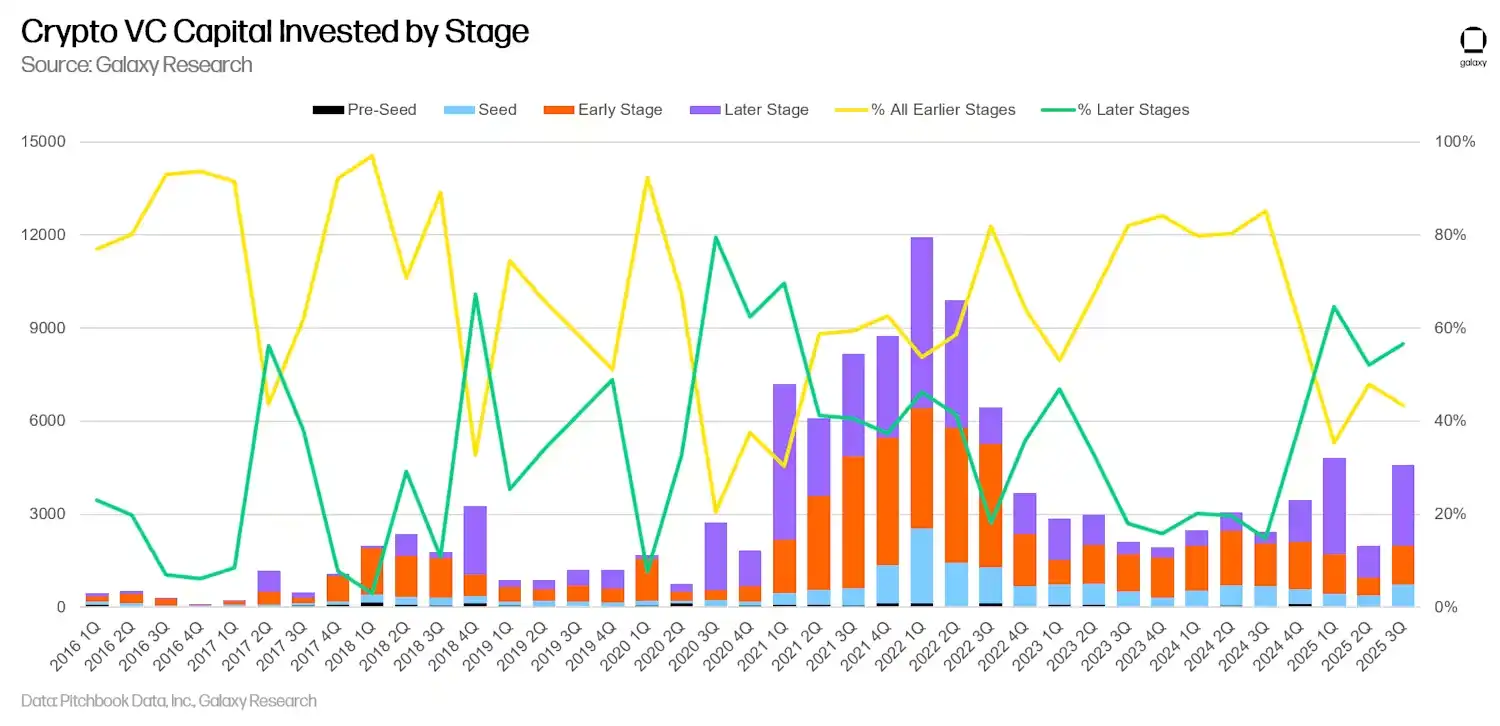

This shift is not unique to Wintermute. The entire crypto VC ecosystem saw deal count plummet by 60% in 2025, from over 2,900 deals in 2024 to about 1,200. While capital is still flowing—global crypto VC total investment even reached $4.975 billion—this money is increasingly concentrated in a smaller number of projects. Later-stage investments accounted for 56% of the total, compressing the share of early seed rounds to a historical low. Data from the US market is even more telling: deal count fell by 33%, but the median investment size grew 1.5 times to $5 million. This means VCs would rather place heavy bets on a few select ventures than cast a wide net.

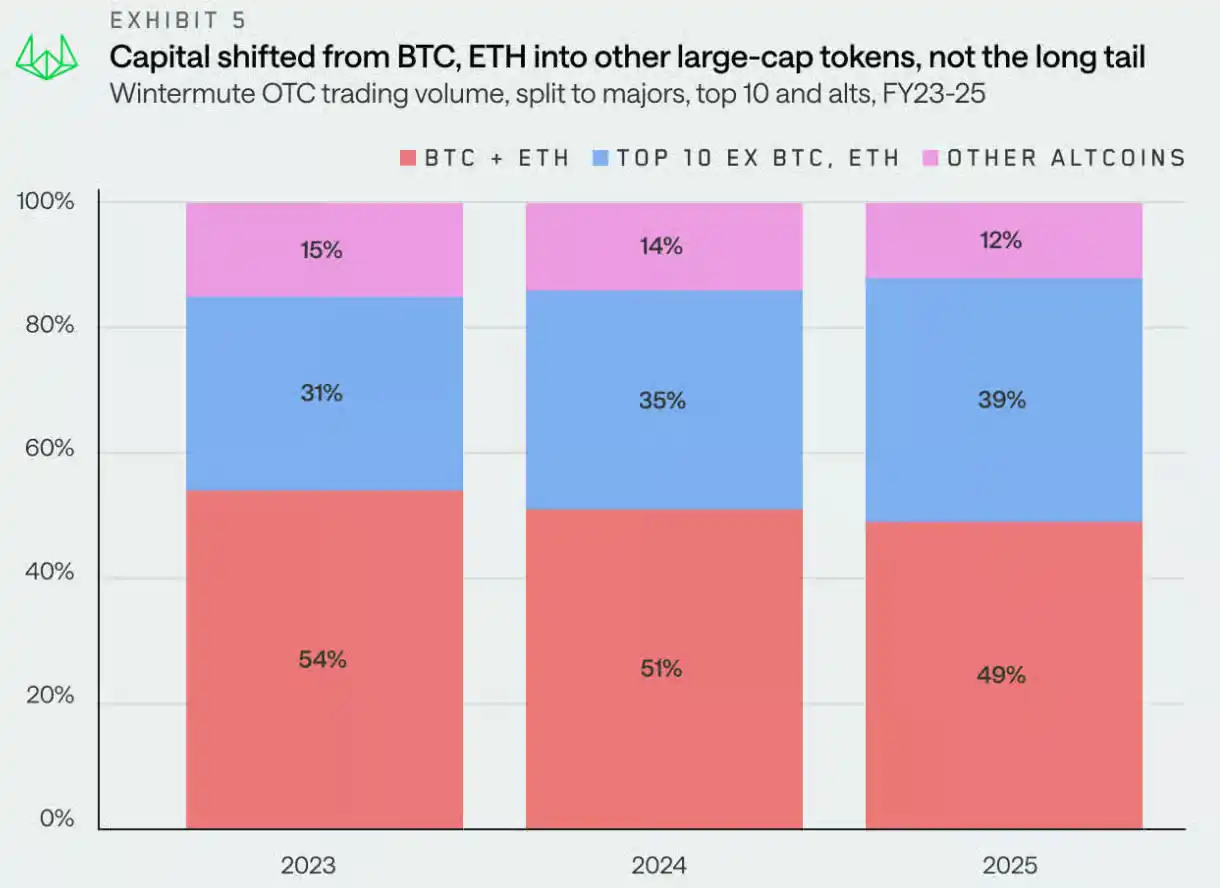

The root cause of this dramatic change is the high concentration of market liquidity. The 2025 crypto market exhibited extreme "narrow-range" characteristics: institutional funds accounted for 75% of the capital, but this money was largely trapped in large-cap assets like BTC and ETH. OTC trading data shows that while the share of BTC and ETH decreased from 54% to 49%, the overall share of blue-chip assets actually grew by 8%. More critically, the altcoin narrative cycle crashed from 61 days in 2024 to just 19-20 days in 2025, leaving no time for capital to spill over into small and mid-sized projects. Retail investors are also no longer chasing cryptocurrencies with the same frenzy as before; they have shifted their attention to AI and tech stocks, resulting in a lack of incremental funds for the crypto market.

The traditional "four-year bull cycle" has completely broken down. Wintermute's report clearly states that a recovery in 2026 will not arrive naturally as it did in the past; it will require at least one powerful catalyst: either the expansion of ETFs to assets like SOL or XRP, BTC breaking through the $100,000 psychological barrier again to trigger FOMO sentiment, or a new narrative reigniting retail enthusiasm. In this environment, VCs cannot afford to bet on projects that only know how to "tell stories." They need projects that can prove, even at the seed stage, their ability to survive until listing and access institutional liquidity.

This is why the investment logic has shifted from "invest in 100 to hit one 100x return" to "only invest in the 4 that can survive to listing." Risk aversion is no longer conservative; it's a necessity for survival. Top funds like a16z and Paradigm are reducing early-stage investments and shifting to mid-to-late stage rounds. The high-profile projects that raised funds in 2025—Fuel Network dropping from a $1 billion valuation to $11 million, Berachain plummeting 93% from its peak, Camp Network evaporating 96% of its market cap—are all delivering a bloody lesson to the market: narrative is dead, execution is king.

II: The Critical Demand for Seed-Stage Profitability

Under this extremely precise scrutiny, the biggest challenge for startup teams is: the seed round is no longer a starting point for burning cash, but a line of survival where you must prove your ability to be self-sustaining.

Profitability first manifests in the hard validation of Product-Market Fit (PMF). VCs are no longer satisfied with beautiful business plans or grand vision statements; they want to see real data: at least 1,000 active users, or monthly revenue exceeding $100,000. More crucial is user retention rate—if your DAU/MAU ratio is below 50%, it shows users simply aren't buying in. Many projects fail here: they have slick whitepapers, cool tech architectures, but just can't provide evidence that users are actually using and willing to pay for their product. Many of the 580 projects Wintermute rejected died at this stage.

Capital efficiency is the second life-or-death threshold. VCs predict that 2026 will see a surge of "profit zombies"—companies with an ARR of only $2 million and annual growth of only 50%, utterly unable to attract Series B funding. This means seed-stage teams must achieve a "default alive" status: monthly burn rate should not exceed 30% of revenue, or better yet, achieve profitability early on. This sounds harsh, but in a liquidity-starved market, it's the only way to survive. Teams need to be lean, under 10 people, prioritize using open-source tools to reduce costs, and even supplement cash flow through side ventures like consulting services. Projects with teams of dozens and alarming burn rates will basically fail to secure the next round of funding in 2026.

Technical requirements are also escalating. 2025 data shows that for every dollar VCs invested, 40 cents flowed into crypto projects also working on AI, a proportion double that of 2024. AI is no longer a nice-to-have; it's a necessity. Seed-stage projects need to demonstrate how AI helps them shorten development cycles from 6 months to 2 months, how AI agents drive capital transactions, or optimize DeFi liquidity management. Simultaneously, compliance and privacy protection must be embedded at the code level. With the rise of RWA (Real World Asset) tokenization, projects need to use technologies like zero-knowledge proofs to ensure privacy and reduce trust costs. Projects that ignore these requirements will be seen as "a generation behind."

The most critical requirement is liquidity and ecosystem compatibility. Crypto projects need to plan their exchange path clearly from the seed stage, defining how they will access institutional liquidity channels like ETFs or DATs. The data is clear: institutional funds accounted for 75% in 2025, the stablecoin market surged from $206 billion to over $300 billion, while the funding difficulty for purely narrative-driven altcoin projects increased exponentially. Projects need to focus on ETF-compatible assets, establish early partnerships with exchanges, and build liquidity pools. Teams thinking "get the money first, worry about listing later" basically won't survive 2026.

Combined, these requirements mean the seed round is no longer a trial but a comprehensive exam. Teams need interdisciplinary配置—engineers, AI experts, financial experts, compliance advisors are all essential. They need to iterate rapidly using agile development, speak with data instead of stories, and rely on sustainable business models instead of funding lifelines. 45% of VC-backed crypto projects have already failed, 77% have monthly revenue under $1,000, 85% of tokens launched in 2025 are underwater—these numbers tell us that projects lacking profitability simply won't survive to the next funding round, let alone achieve a listing exit.

III: Warnings and Strategic Shifts for Investment Institutions

For strategic investors and VC institutions, 2026 is a watershed: either adapt to the new rules or be eliminated from the market. Wintermute's 4% approval rate isn't boasting about their selectivity; it's a warning to the entire industry—institutions still using the old "spray and pray" model will lose badly.

The core of the problem is that the market has shifted from speculation-driven to institution-driven. When 75% of the funds are trapped in institutional channels like pension funds and hedge funds, when retail investors have fled to trade AI stocks, when the altcoin rotation cycle shortens from 60 days to 20 days, VCs who continue making scattergun investments in projects that only tell stories are actively giving money away. GameFi and DePIN narratives fell over 75% in 2025, AI-related projects fell an average of 50%, and the October liquidation cascade event saw $19 billion in leverage wiped out—all pointing to one thing: the market no longer pays for narrative, only for execution and sustainability.

Institutions must change direction. First is a fundamental change in investment criteria: from "how big can this story get" to "can this project prove profitability at the seed stage." They can no longer sprinkle large amounts of capital in the early stages, but must either heavily back a few high-quality seed projects or simply shift to mid-to-late stage rounds to reduce risk. Data shows that later-stage investments already accounted for 56% in 2025; this is no coincidence but the result of the market voting with its feet.

More important is the repositioning of investment sectors. The fusion of AI and crypto is not a trend; it's reality—investment in the AI-crypto crossover space is expected to exceed 50% in 2026. Institutions still investing in purely narrative-driven altcoins, still ignoring compliance and privacy, still disregarding AI integration will find their projects unable to access liquidity, list on major exchanges, let alone exit.

Finally, there is the evolution of investment methodology. Active outbound sourcing must replace passively waiting for business plans (BPs), accelerated due diligence must replace lengthy evaluation processes, and response speed must replace bureaucracy. Simultaneously, they must explore structural opportunities in emerging markets—AI Rollups, RWA 2.0, stablecoin applications for cross-border payments, fintech innovation in emerging markets. VCs need to shift from a "gamble for 100x returns" gambler mentality to a "select the survivors" hunter mentality, using a 5-10 year long-term vision rather than short-term speculative logic to screen projects.

Wintermute's report is essentially sounding the alarm for the entire industry: 2026 is not a natural continuation of the bull market, but a winner-take-all battlefield. Those players—whether entrepreneurs or investors—who adapt early to this precise scrutiny will occupy the high ground when liquidity returns. Those still using the old models, old thinking, and old standards will find their invested projects breaking down one after another, their held tokens going to zero one by one, and their exit channels closing one after another. The market has changed, the rules of the game have changed, only one thing remains constant: only projects that are truly profitable, that can truly survive to listing, are worthy of capital in this era.